- The Concern

- Applications

- Education ERP System

- Hotel Management System

- XeniaS Restaurant Software

- Content Management System

- Online Newsletter

- Attendance Management System

- Payroll System

- Doctors Schedule & Appointments Management System

- Online Shopping Cart

- Alumni Management System

- Stock Management System

- Online Admission System

- Online Examination System

- Online Learning System

- Tourism Automation System

- Library Management System

- Products & Services

- Sectors

- Support

- Reach Us

- Billing

- Blog

- Artificial Intelligence Positive Impact in Todays Life

- Why Cyber Security is important in today's life

- Artificial Intelligence Negative Impact in Todays Life

- Google knows you better than you know yourself

- Impact of YouTube in Today's World

- Digital Trust in Technology

- How Robotic Process Automation is impacting today's life

- What's Trending in Web Development 2023?

- Why digital trust is important for the digital services?

- Negative Impact of YouTube In today's World

- What is edge-computing?

- Internet of Things (IoT)

- About the buzzword named DevOps

- Cloud Computing

- Augmented Reality

- Future of Artificial Intelligence (AI)

- 5G status in India

- How Technology is changing the HealthCare Industry

- Need of Automation in Today’s World

- Brain computer assistance

- Smart Devices in Today’s Life

- Role of Biometrics

- Blockchain

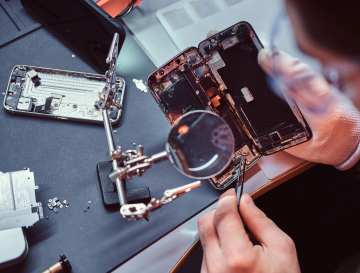

- Replaceable battery in Smartphones is coming back

- Difference between VFX, CGI and SFX

- After DTH, it is DTM (Direct to Mobile) TV on Phone without Internet coming soon

- 3D Printing (A New Innovation)

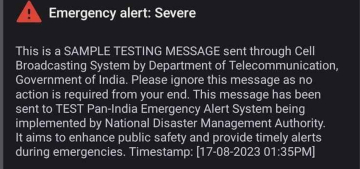

- Government’s initiative on emergency mobile alert system

- Constant Evolving Cyber Security

- Aadhar Enabled Payment System (AEPS)

- Impact of smartphones on TV market

- Current Situation of IT Sector in India

- How Virtualization is changing Automation

- Natural Language Processing

- Apple considered switching to DuckDuckGo from Google for Safari

- How smartwatches have made our life easier

- Difference between Flagship phones and non-flagship phones

- Be safe from Dark Web

- Digital Transformation

- Use of drone to transportation in medical, commercial, utility sector

- Difference between Edge Computing and Fog Computing

- Additive Manufacturing

- Biometric - Attendance Management System

- Importance of IT sector in today’s world

- End of Work from Home [WFH] Era

- Top 5 Upcoming Technology

- Apple introduces new Apple Pencil with USB-C charging

- Smarter Devices

- Reliance Jio demonstrates its satellite- based gigabit internet in India

- Tata to make iPhones in India for local and global markets, Indian IT minister confirms

- Encryption and Decryption

- Futuristic Mobile Phones

- Bridging the Digital and Physical World

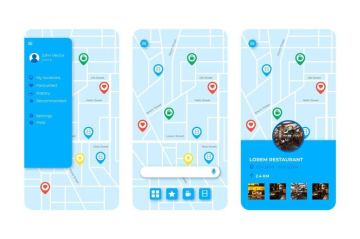

- How Google Maps solved India’s street name problem; Former employee explains

- Strategic Technology Trends – How they impact business goals.

- Why Google has paid a hefty sum to Apple to be in Search engine

- Meta launches AI based video editing tools

- OpenAI [known for ChatGPT] co-founder Sam Altman was fired last week, then almost rehired over the weekend

- Breakthrough Progress in Hologram Technology

- India’s government has issued a warning to social media giants Facebook and YouTube, to enforce rules against spread of deepfakes.

- The Action taken by Countries other than India against Deepfakes

- Governments’ initiative with Gajraj AI to save Elephant hit by trains

- Inactive Google accounts to be deleted from 1st of Dec 2023

- The VoLTE age is over, get ready for Vo5G

- YouTube launched Brand Connect and Podcast Features for creators in India

- Bluetooth scam

- Google Maps is changing in India

- Use of technology in cricket is getting advanced

- WhatsApp to end providing free google drive storage for photos videos and chat history

- Google Chrome tests blocking third party cookies

- Indian Space Research Organization (ISRO)

- AI advancements will drive even more energy usage

- Best “Wear OS” apps to install on your smartwatch in 2024

- Open AI trying to breach privacy – Reported by Garante

- Not Chasing DSLRs anymore, now smartphones are giving a huge competition in terms of good quality pictures and videos

- India shipments tops in smartphones selling

- An important news for all the Paytm users

- Another milestone for Indian payment system UPI

- Be Aware of Visa Scams

- Google Chrome Users should be aware of the new vulnerabilities

- Online Doctor Appointment Management System

- Sam Altman (Founder of OpenAI) is all set to comeback with his new initiative to the Tech industry

- OpenAI is introducing a new personal memory feature for ChatGPT

- Gemini AI image generator has been stopped temporarily by Google over inaccurate results

- India will play an important role in helping make sure AI is built responsibly

- Meta and LG announce collaboration to create advanced XR Technologies

- Collaboration between this companies to lead the digital transformation of the media and entertainment industry

- Tumblr and WordPress, both popular platforms, are reportedly selling user data to two AI giants

- AI models are well-crafted, leading to more accurate and relevant outputs than humans

- Meta sues former ‘disloyal’ executive, accused of stealing important documents

- Google had pledged $26.98 million to help people in Europe learn to use AI

- To cement its supremacy over the AI sector, Nvidia has unveiled its flagship AI chip

- By breaking language barriers, and ensuring equal users for all access through Universal Acceptance

- Microsoft asserts that customer data is not used for training models without permission and is not shared with third parties

- The lawsuit accuses Apple of abusing its power by restricting access to its hardware and software

- A class-action lawsuit settlement between google and users who claimed Google tracked their browsing activity even in “incognito mode”

- Small AI models like Phi-3 are gaining traction for their cost-effectiveness and suitability for personal devices, offering optimal performance without compromising on functionality

- New Scam Alert – “Hello? Hello?...” and the call is cut, and here all your bank balance vanish in one go

- Your number will be blocked within 2hours press 9... In the name of TRAI new scam has knocked the door

- Photos in Google Library are been unmanageable

- Disadvantages of Free SSL vs Advantages of Paid SSL (Secure Sockets Layer)

- The Northern Lights effect on Technology

- The transformative power of AI in the hospitality industry

- Tech companies are firing their employees due to its technological advances

- USA aims to stay ahead with China in the realm of Artificial Intelligence (AI)

- NFC card’s purpose, use, and examples

- The importance of Software Developers Company

- Low Coding Development

- SCAM ALERT!! All India Pregnant Jobs: A Tricky Plan To Be Aware Of -

- No Code Development

- Review of the Apple iPad Mini :

- To compete with the iPad, Google is probably converting Chrome OS to Android

- WARNING!! Avoid being fooled: Sextortion email scams are conducted by hackers using authentic Microsoft email addresses:

- Google Circle to Search will soon have a new app drawer and a redesigned user interface: This is how it seems.

- Know your google map better: Tips and Techniques

- Microsoft launches a $4 million bug bounty hacking competition at Ignite 2024:

- An AI-powered fashion expert is Google's Best App of 2024 in India

- At Ignite 2024 Microsoft will demonstrate AI agents capable of performing tasks on their own:

- Teachers can receive free AI training from Open AI :

- Meta intends to challenge the India antitrust ruling on WhatsApp because it disagrees with it.

- Global rules and standards for AI are desired by more than 81% of corporate executives according to the TCS Report

- Release of Android 16 Developer Preview 1 Highlights Schedule and Compatibility

- Valuations for the IT industry Morgan Stanley is not cheap, but it is also not in the sell zone:

- Job Opportunity in IT sector to rise in 2025: Report

- Growing Cybersecurity Risks in the Digital Age .

- SBI cautions customers to save money!!

- SPADEX: a twin satellite mission

- QR codes are increasingly being scanned in India! UPI is the most prevalent transaction mechanism in rural and semi-urban India.

- The iPhone 17 Air is set to be released in 2025, with foldable Apple devices expected by 2026?

- The Advantages of Outsourcing Software Development :

- YouTube says it will to remove videos in India that have clickbait titles and thumbnails

- The Textile Industry Evolutionary Response to Artificial Intelligence::

- Review of Apple Watch Series 10 Value for Money and Time

- What is Education ERP and Why Do You Need It

- An increase in digital transformation deals in FY25 signals a return to growth according to IT businesses---

- Wipro will pay 40 million dollar to acquire Applied Value Technologies an IT consulting firm:

- Is tech industry already on cusp of artificial intelligence slowdown?

- Top Benefits of Using Education ERP

- LTIMindtree creates an AI-powered Cyber Defense Resiliency Center:

- IT Professionals Quit C-Suites for AI Ventures:

- Google efforts to regulate targeted advertising in the United Kingdom have sparked concern:

- Revolutionizing Academic Management Top Education ERP Examples:

- 2024 will be the year of AI-powered PC and Macs

- WhatsApp Web is finalising a feature that lets users search images from Google in reverse Here's how:

- Seeing cyber threats in 2024 Key events and what might be expected in 2025:

- Education ERP Software: An Overview

- Revolution in Indian AI & Data Centre A global force in the making:

- Technologies to watch in 2025 A Comprehensive Guide:

- Know how advanced features make education ERP systems requirements for any institution:

- Out of all the stock in cloud computing, which one will perform the best for the year ending at 2025?

- YouTube statistics 2025 demographics users by country and more:

- 40 plus web development sites that will change the way one build websites in 2025:

- Introduction to Education ERP Solutions:

- Tata Electronics looks way beyond Apple and wants to create for Xiaomi and Oppo:

- Top AI Search Engines for 2025:

- Operator an OpenAI agent that handles web tasks

- Step-by-Step Guide to Implement Education ERP

- DeepSeek AI: The Chinese AI App that has World talking

- Web Technology Trends in 2025: Generative AI

- Developing Enterprises Preparing For Upcoming Trends In 2025 Technology:

- Meta AI will get more personalised by using data from WhatsApp, Messenger and Facebook

- AI Tools Together With Their Techniques Which Will Be Prominent In 2025.

- IT Industry applauds Budget 2025's emphasis on skilling, Make in India and more.

- Overcoming Education ERP Deployment Hurdles

- DeepSeek R1: Multiple security flaws in iOS app, recent findings reveal

- Google made its most experienced AI models for public access, major achievement in its virtual agent project:

- Amazon has announced a hardware event to launch a new Alexa feature on 26th of Feb 2025:

- Google Messages to soon get WhatsApp video calling support

- Best Practices for a Successful Education ERP Rollout:

- Instagram announces teen accounts with parental control in India

- OpenAI denies to use the content of Indian media groups in training:

- Apple co-operates with SpaceX and T-mobile for Starlink satellite connectivity on Iphones:

- JioHotstar is launched as the merger of Jio, Hotstar by the Reliance:

- 7 Steps to Implement Education ERP

- Facebook updated its policy concering Live Videos and now they will be deleted 30 days afterwards.

- Government orders ban on 119 apps on Google Play Store on National security ground

- A UK study has revealed that AI Generated content increases the risk of bank runs.

- Karnataka tourism goes digital: Interactive new platform.

- Maharashtra Government working on a dedicated AI policy, developing GCC parks

- Instagram Reels may be set its stand-alone app: Report

- Adobe launch free Photoshop App in a bid for young users:

- Google is working to replace SMS-based two-factor authentication from Gmail with QR codes:

- Skype is gradually shutting down to drive its users towards Microsoft Teams:

- The True Cost of Implementing Education ERP

- Microsoft will be releasing its AI app, Dragon Copilot exclusively for the healthcare.

- Google is warning Chrome users to delete these 16 popular extensions immediately.

- Netflix email scam alert: Netflix members don't open emails with this subject line.

- Google trials an AI-exclusive version of its search engine.

- The newly introduced Gemini 2.0 Flash AI model for image generation comes with exciting possibilities.

- Amazon is putting more intelligence into Alexa.

- Comprehensive Guide to Education ERP Integration

- Hackers could hijack your life through one phone call: See how this merging calls scam work.

- NPCI is going to unlink UPI on such numbers starting from 1 April: Check and see if you are one of them.

- Swiggy instamart starts 10-minute phone delivery across 10 cities.

- Choosing the Best School ERP System.

- Importance of Technology:

- The best AI tools (Tested and Tried)

- Check point report warns: PDFs are the latest cyber weapon of choice.

- The best and trending AI tools: Tested by technology.

- Top School ERP Software:

- The increasing risk of a mule account: when fraudsters use your bank account.

- PhonePe launches “UPI circle” for shared payments:

- Top Features of School ERP Software:

- Google's new prompt engineering playbook: 10 key points on mastering Gemini, and other AI tools.

- AI-generated background music tool was launched by YouTube for creators.

- Affordable School ERP Solutions

- India ready to work magic of UPI with AI:

- Evolution of fraud detection: From static rules to AI insight analytics:

- Four steps to authorize people's with AI fluency:

- Benefits of School Management Software:

- ChatGPT Adds Shopping Help, Increasing Competition with Google:

- Top University ERP Solutions for 2025:

- Open AI is negotiating with Microsoft for fresh funds and future IPO, reports FT:

- Request a School ERP Software Demo Today.

- Google releases “AI Mode” in the next phase of its journey to change search

- I/O Edition: Google has announced everything at the Android show: Android 16.

- The Best ERP for Higher Education.

- Gemini smarts are arriving on more Android devices:

- Top ERP solutions for universities

- Google begins to show ads in AI Mode, extends AI Overview ads to desktop search:

- Finally, after 15 long years, WhatsApp arrives on iPad.

- Must-have features in university ERP software.

- TRAI is not calling: Frauders impersonating officials are fooling even the smartest.

- Benefits of ERP in higher education

- Google Gemini now supports scheduled actions, launches a new Live swipe gesture.

- How to make UPI payments offline.

- WhatsApp will soon utilize Meta AI to summarize unread messages: Here's how it works

- Meta AI and Edits app now allows you to edit videos with generative AI.

- Google is now testing the Search-Live feature with AI Mode.

- How India's e-commerce companies are quietly becoming smarter with AI tools from Microsoft.

- Samsung is likely to launch its very first Android XR headset in the near future and here is everything we know about it.

- Choosing the Right ERP for Universities

- SparkKitty, a new malware that steals screenshots from your phone: Everything you need to know

- Doppl, Google’s new app that allows users to try new clothes digitally

- Advantages of Cloud-Based Education ERP

- Google’s customizable Gemini chatbots are now in Docs, Drive, Sheets, and Gmail

- BitChat; Jack Dorsey's messaging app that works without internet using Bluetooth Know its features and how it works

- Key Benefits of Cloud ERP Systems

- Web Development Trends for 2025

- Cloud vs On-Premise Education ERP

- Top Cloud ERP Providers for Education

- Google’s Gemini 2.5 Deep Think, now available to Google AI Ultra subscribers

- Showrunner, the AI that can generate entire episodes of TV shows

- How Cloud ERP is Transforming Education

- Get Pricing for Cloud ERP Solutions Today

- IT & BPM Industry in India

- Why Choose a Customizable ERP for Education

- Apple, Google and Meta are working to perfect a science fiction gadget: The Universal Translator

- Tailored ERP Solutions for Education

- Artificial Intelligence (AI): its Importance, Advantages and Disadvantages

- Cryptocurrency

- Data is the New Gold of the Economy

- Digital Transformation in the Tourism Sector

- The Benefits of Modular Education ERP

- ERP Customization: Solutions for Schools

- The most common types of scams in India

- Personalized Education ERP Software

- Customizable Features in ERP Systems

- Ensuring Data Security with Education ERP

- How Secure ERP Systems Benefit Education

- OpenAI testing to launch impression-based ads in ChatGPT

- Stop Partitioning Your SSDs; Learn Why should you not partition SSDs

- Data Protection Best Practices in Education ERP